Financial literacy is essential for students of all ages. It’s crucial for them to understand how to manage their finances and become financially responsible. Are you looking for free, high-quality financial literacy resources? I have some free resources to share with you that are perfect for kicking off the school year!

EVERFI’s Financial Literacy resources are excellent for the start of the school year. You can choose the one that is the best fit for your students and jump right in. These multimedia resources are perfect for students in middle school and high school.

Let’s take a look at EVERFI’s Financial Literacy resources so you can pick which one to dive into as you head back to school!

Financial Literacy Resources for Teens

Teaching financial literacy to middle and high school students is essential for many reasons. Understanding financial literacy equips students with the skills they need to manage their finances and make strong decisions as they move into adulthood.

When students understand financial concepts, they are better prepared to make big and small decisions regarding their finances. One of the reasons I’m so excited about the free financial literacy resources from EVERFI is because it’s essential to set up students for success at an early age. As adults, we can appreciate the complex nature of navigating online banking, applying for a mortgage, and understanding the impact of opening up another credit card.

The financial literacy resources I outline below encourage responsible money management and help students develop habits that can lead to lifelong financial stability. You can incorporate these lessons right into the curriculum – you’ll even see standard alignment for each one. It’s a great way to combine traditional academic goals with practical skills students can apply in middle school, high school, and beyond.

Middle School Financial Literacy Resources

EVERFI has a handful of financial literacy resources designed specifically for middle school students. These resources include FutureSmart: Financial Literacy for Middle School and Smart Economics: Economics for Middle School. If you’re teaching middle school this year, they are both worthy of your consideration.

FutureSmart: Financial Literacy for Middle School includes seven digital lessons, all are 25-mins long. This free digital course consists of a story-based narrative and interactive exercises for sixth, seventh, and eighth-grade students. Students who take part in the course learn to make decisions about their personal finances — including how to set saving goals and create a budget.

In the Smart Economics: Economics for Middle School course, students can move through three digital lessons, each one is 10 minutes long. Middle school students will learn basic economic concepts and identify factors that impact the price of consumer goods.

High School Financial Literacy Resources

If you’re working with high school students this year, there are a handful of different options from EVERFI to choose from. You can start with the EVERFI: Financial Literacy for High School course, which covers topics like budgeting, consumer skills, and more. Alternatively, you can dive into the financial literacy resources on one of the following topics:

Accounting Careers: Limitless Opportunities: In this course, students explore connections between accounting and their own interests, hobbies, and career aspirations. They’ll learn how accounting skills can be relevant to their personal and professional lives and can help them achieve their financial goals.

Sustainable Investing Essentials: In this course, students dive into the world of investing and explore its risks and opportunities. Students engage with characters at various levels of financial confidence and learn about sustainable investing.

Marketplaces: Investing Basics: In this five-lesson course, students explore marketplaces, the economy, and how startups go through the IPO process. Then they’ll learn about different types of financial assets and the importance of diversification when investing. This course helps students understand how the market works and have the confidence to participate in it.

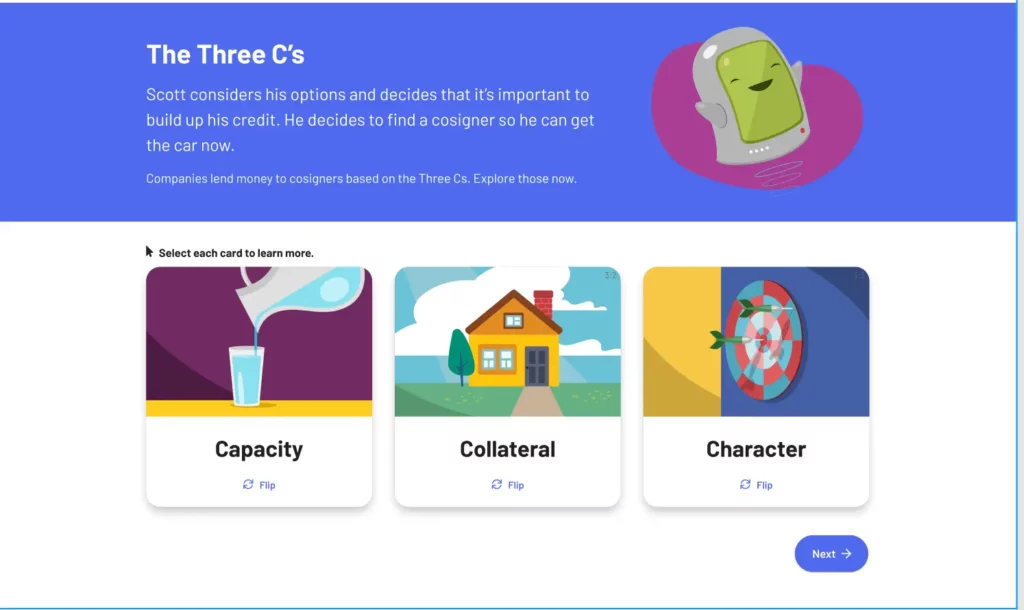

Build: Credit Fundamentals: This course is all about credit and helping students understand what credit is and how to acquire it. Students will then learn about growing and managing credit and how to recognize identity theft.

EVERFI’s Financial Literacy Resources

This year, EVERFI’s Financial Literacy courses were endorsed with the ISTE Seal and Digital Promise Product Certification, indicating they are research-based and meet high standards of quality. So if you’re ready to introduce students to financial literacy skills, EVERFI’s courses are the perfect place to start.

Learn more about each course by clicking on the links above, or head straight to this page for an overview of all the financial education resources EVERFI has to offer!